What is Money Transfer Online Software?

Money transfer online software is a fully-featured and customized software solution for transferring money from one bank account to another bank account. This is a real-time application that supports money transfer in all the banks which is supporting NEFT & IMPS mode of transactions. This is a fast, safe & secure method of transferring money from one account to another bank account.

Money transfer online software provides a robust solution for money transfer business. It fulfills all the aspects of the money transfer business. By using money transfer online software, you can transfer money easily by just one click in all our India. This is also known as domestic money transfer.

Today money transfer service is very trending globally. If we talk about daily life, If we talk about the corporate field, money transfer has become very important. You need money transfer to send money to your family If you live away from your home. Incorporate, to pay for goods & services, for wages, to pay salaries, money transfer required every time.

In short, we can say this is very important & you can’t deny using money transfer.

Different Types of Money Transfer

There are several ways of money transfer from one bank account to another bank account. As the technology is growing, transferring money from one account to another account is becoming very easy. Now you can perform a money transfer service by just one click. Now a day’s money transfer is a very fast, safe & secure cashless transaction method.

Here we talk about the two best money transfer types.

- NEFT

- IMPS

- RTGS

NEFT (National Electronic Fund Transfer)

NEFT stands for national electronic fund transfer service. This is the most popular and easiest method of transferring money from one bank account to another bank account.

To perform a money transfer service using NEFT, you required beneficiary account number and IFSC code.

There is no limit of money transfer in NEFT, this is the reason it is used mostly. You can transfer any amount to the beneficiary account.

IMPS (Immediate Payment Service)

IMPS stands for immediate payment service. This is also known as Instant fund transfer service. You can perform this service at any-time. To perform money transfer using IMPS, you required a beneficiary account name and mobile number.

IMPS is different from NEFT, in this you can’t transfer any amount. There is a set of limitations that you can transfer from one bank to another bank.

RTGS (Real Time Gross Settlement)

RTGS stands for real-time gross settlement. This is quite similar to NEFT mode of transaction. If you want to perform more than 2 transfers in a day, you can use it.

There is no upper limit of transaction line NEFT, but it takes almost 30 minutes to credit funds.

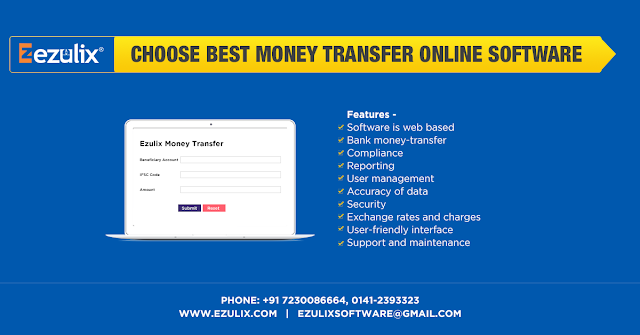

What are the Main Features of Money Transfer Software?

There are many features of money transfer online software which you must consider before buying a new money transfer software service for online money transfer business.

- Fast, Safe & Secure Money Transfer Application

- Transfer Money Anytime Anywhere

- Support NEFT & IMPS mode of transaction

- You can transfer money to any bank of India

- Prepare & Maintain Reports of All the Transactions

- User-friendly Interface

- Accuracy of Data

- Reporting

- Scalability

- Support & User Management

Read Continue: Money Transfer Online Software

.png)

Thanks for provide great informatics and looking beautiful blog, really nice required information & the things i never imagined and i would request,wright more blog and blog post like that for us.

ReplyDeleteMobile Recharge Software

whitelabel Recharge solutions